Cash Saving Insurance Tips To use Now

In case you have a spouse and youngsters and are the primary income earner of the household, you do not want to depart them able of hardship ought to anything occur to you. Yet with out considering the purchase of a life insurance coverage coverage, it is a situation that could turn out to be a actuality. Listed below are some things you want to know.

A fundamental life insurance coverage is an efficient investment to make for a newborn baby. Insurance coverage is relatively low-cost for infants and prices little to take care of while the children grow up. By the point the youngster becomes an grownup a well-chosen policy that has been fastidiously maintained by his or her parents will likely be a major financial asset.

Be Ways in which You can save A Ton Of money On Life Insurance coverage and solely by life insurance from companies which are in a powerful financial place. Ranking businesses like Customary & Poor's, Moody's and others give scores to insurance coverage companies. Don't work with any company that does not have an "A" ranking from these agencies to guard your investments.

Be cautious when you see a benefit cap in your health insurance policy. While including a profit cap can drastically lower your premiums, it may end up costing you a lot more in the long term. In case you have a profit cap set at $25,000, but have an accident leading to $75,000 in hospital bills, you can be required to pay the distinction.

Actions like bungee leaping, scuba diving, or skydiving carry dangers which will equal higher life insurance premiums for you. Additionally, certain occupations, reminiscent of a racer or a helicopter pilot, could possibly be thought of by the insurance coverage provider to be very high risk. Thus, your premiums will be increased.

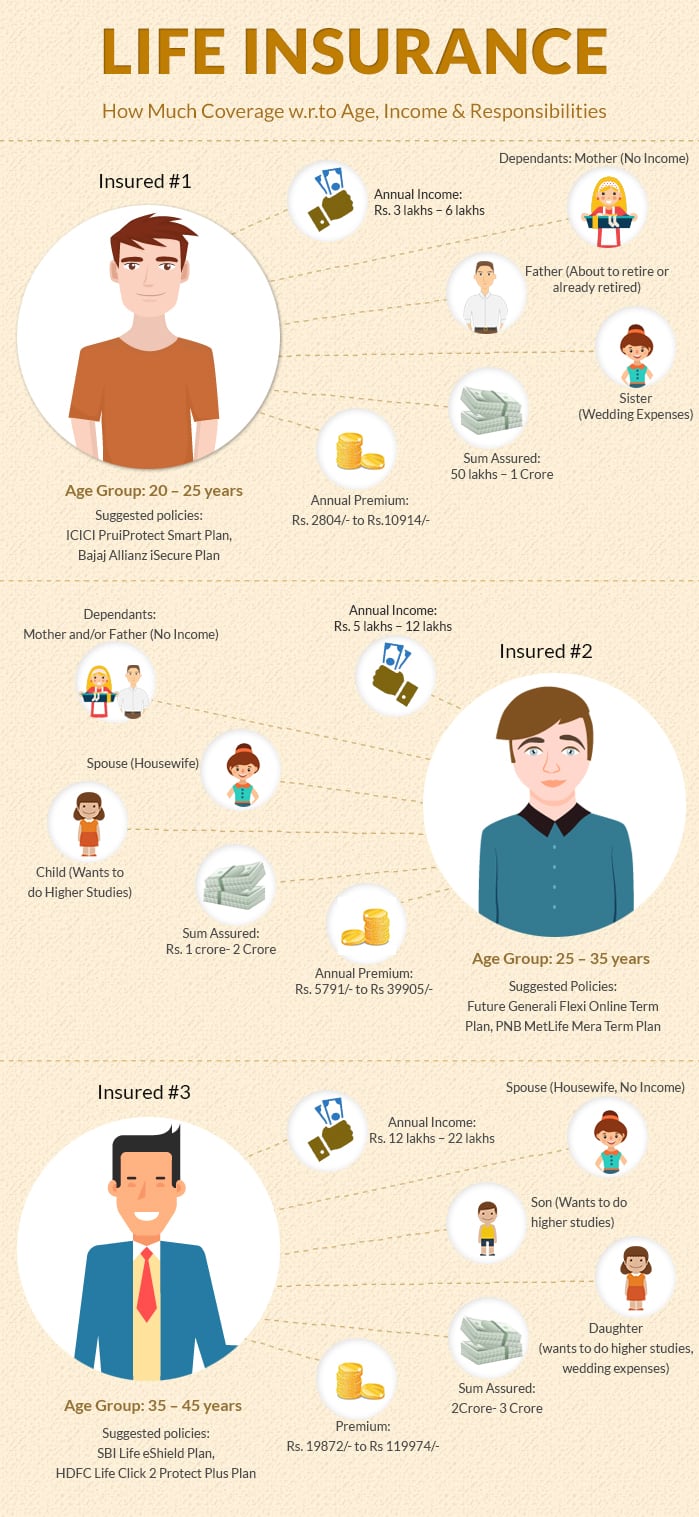

When you're selecting your life insurance coverage policy, it will be important to find out how a lot protection you truly need. The sum of money that will be needed after your dying goes to be specific to your loved ones's state of affairs, so you are the just one who can calculate the wanted coverage. Shopping for Insurance coverage? Read This advice First! let a salesperson push you into extra protection than you really need.

When shopping for Easy Steps For locating The correct Life Insurance coverage , consider your health and if there's anything you can do to improve it. Individuals with higher health get higher life insurance coverage rates. If you'll be able to lose a little further weight, cut back your cholesterol, or give up smoking, you will discover that quotes for life insurance might drop significantly.

You need to assessment your life insurance protection wants a minimum of once a year. As your loved ones adjustments, so do their monetary needs. When you have another youngster, your protection needs will increase, while you is likely to be over-insured as an empty nester. Test periodically on what you want to keep away from paying an excessive amount of or leaving your loved ones within the lurch.

Though it may seem tempting, mendacity about your well being, occupation or way of life in order to cut back your life insurance coverage premium is extremely risky. Insurance firms examine many claims, and, in the event that they suspect that you gave them false info, your claim may be denied or your heirs might spend years in unnecessary litigation. Whether you a smoker, a lumberjack or an extreme sports enthusiast, make sure your insurance company is aware of it.

Life insurance might help ease the burden to your loved ones by serving to with funeral and burial bills. Policies additionally pay your loved ones an quantity that you simply designate. For a comparatively low monthly price, your family could be covered $100,000, $250,000, $500,000, or one other quantity that is best for you.

You may improve your risk class by taking steps to higher your well being. This contains doing things like shedding weight, quitting smoking, lowering your bad cholesterol, lowering your excessive blood stress, and much more. You might also get exams prior to making use of for insurance coverage to keep away from surprises. A few of these wholesome modifications can save you bundles of money over the life of a policy.

If you are uncertain about what sort of life insurance coverage coverage to decide on or how much coverage you want, consider hiring a monetary professional to help you together with your determination. There are various complicated components to contemplate when selecting life insurance, and an excellent monetary professional will consider all of them in figuring out your needs.

Select Getting The most Out Of Your Life Insurance Spending . This type of life insurance coverage provides the most effective protection for most people from the age of 20 till 50. It is easy to know and acquire, nevertheless it nonetheless provides your loved ones what they need in terms of financial safety in the event of your loss of life.

Life insurance coverage is a kind of issues that may appear like something your parents need, not you. It is likely to be time to look in the mirror and understand, you are all grown up. Grown ups want life insurance coverage to protect their households from being stuck with their debts and to offer dwelling bills that their family cannot pay on their very own. Its a safety you shouldn't leave your loved ones without.

Look at the score for the life insurance coverage firm that you are all in favour of buying from. You may be wasting your cash if you do not get a coverage from a company with a safe background. You want to find a enterprise with no less than an "A" score.

Check your life insurance coverage coverage contract very rigorously. Once you receive the policy, you usually have 10 days to cancel for a full refund if you discover it to be unsatisfactory. Be certain that that all the advantages you utilized for are included, and the premiums are what you agreed to pay. If there may be anything you do not understand within the coverage, you must name the corporate for clarification. In case you are still not glad, remember to return it inside 10 days.

To save money in your life insurance coverage policy and insure that you've got made the best resolution, purchase your coverage from an organization that's financially stable. Insurance firms are rated by independent companies. Look for a corporation with the best ranking potential.

Utilizing the advice above, you must now be slightly wiser as to whether or not shopping for a life insurance coverage coverage can be useful to you and your family. Whereas it may have a monthly cost that seems like an additional burden, is the financial burden your family would face without you not just as a lot, if no more?